The new tax year starts 6th April 2024 and will end 5th April 2025 and here are some key changes for this upcoming year: National Insurance (NI) Cuts: The income tax rates and thresholds are as follows: England and...

This will depend on the employees pay structure and if an employee is paid hourly. Salaried employees Employers with salaried workers are paid their normal salary, however those employees who are paid close to the minimum wage you do...

National Insurance (NI) has long been a significant component of the UK’s taxation system, contributing to various social welfare programs and services. However, there are upcoming changes to the NI set to take effect in January 2024 that employees...

The Chancellor of the Exchequer has presented his Autumn Statement 2023 to Parliament, Wednesday 22 November 2023. Here’s what we understand so far… The Living Wage is to have it’s largest ever cash increase to the rate following the...

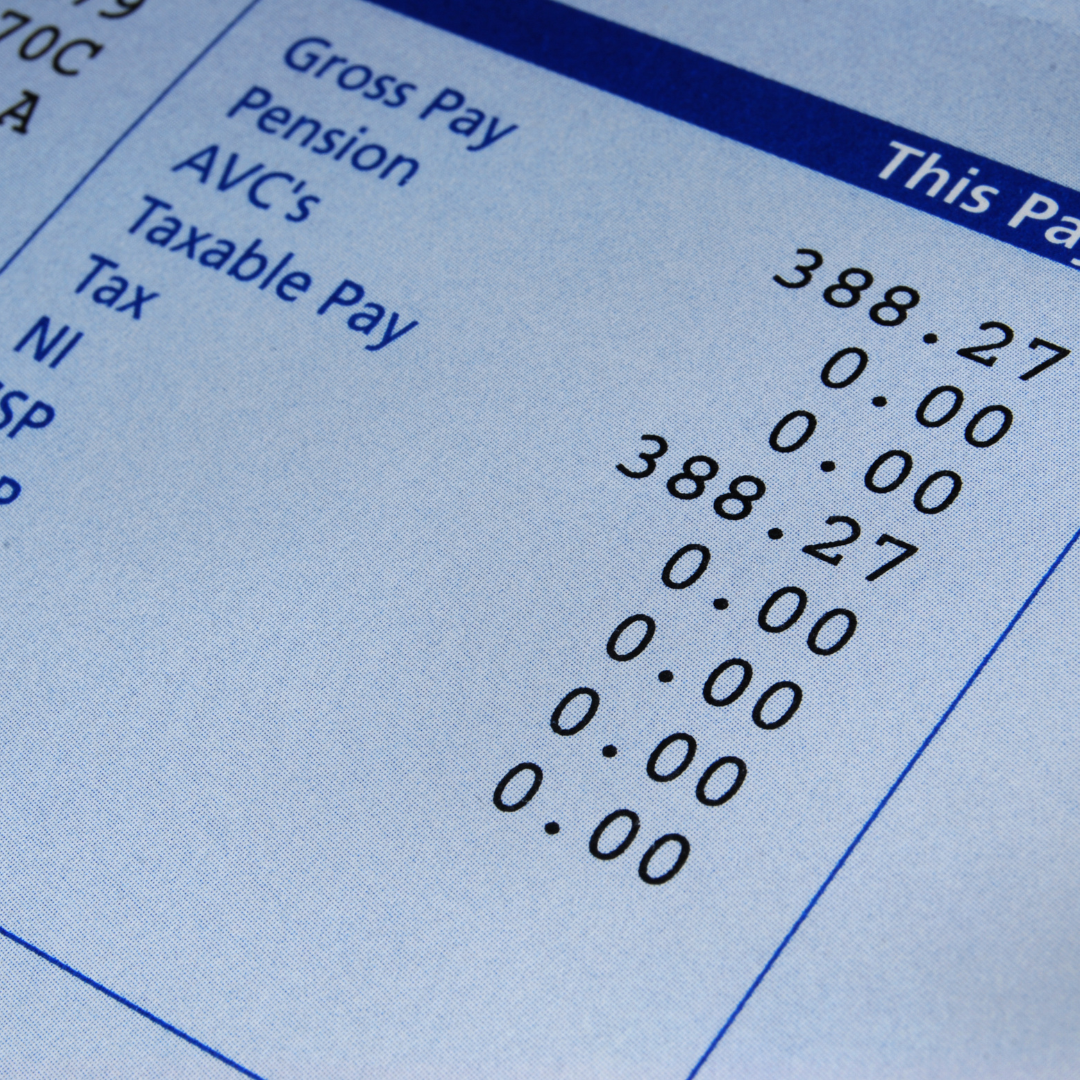

Managing payroll is an essential aspect of running a business. It’s not just about ensuring your employees receive their hard-earned wages on time. It also involves a complex web of legal requirements and regulations a company must adhere to....

The landscape of payroll management has transformed significantly in the last 15 years. Traditional methods of payroll processing, characterised by manual data entry, paperwork, and error-prone calculations, have become obsolete in today’s fast-paced business world. To enhance productivity, payroll...

We all know that payroll management is an essential aspect of running a business, ensuring that employees are accurately paid as per their contractual agreement. However, it’s no secret that payroll processes can often turn into a source of...

Here at Excel Payroll Solutions, we understand that managing payroll is a critical aspect of running a business. It requires time, expertise, and attention to detail. We’re finding many businesses, no matter their size, are discovering the numerous advantages...