National Insurance (NI) has long been a significant component of the UK’s taxation system, contributing to various social welfare programs and services. However, there are upcoming changes to the NI set to take effect in January 2024 that employees need to know.

Introduced in 1911, National Insurance was initially designed to provide financial support to workers facing unemployment or in need of medical treatment. Over the years, its scope has expanded to include funding for the state pension, other benefits, and contributions to the NHS. Notably, the government can borrow from the National Insurance fund to finance various projects.

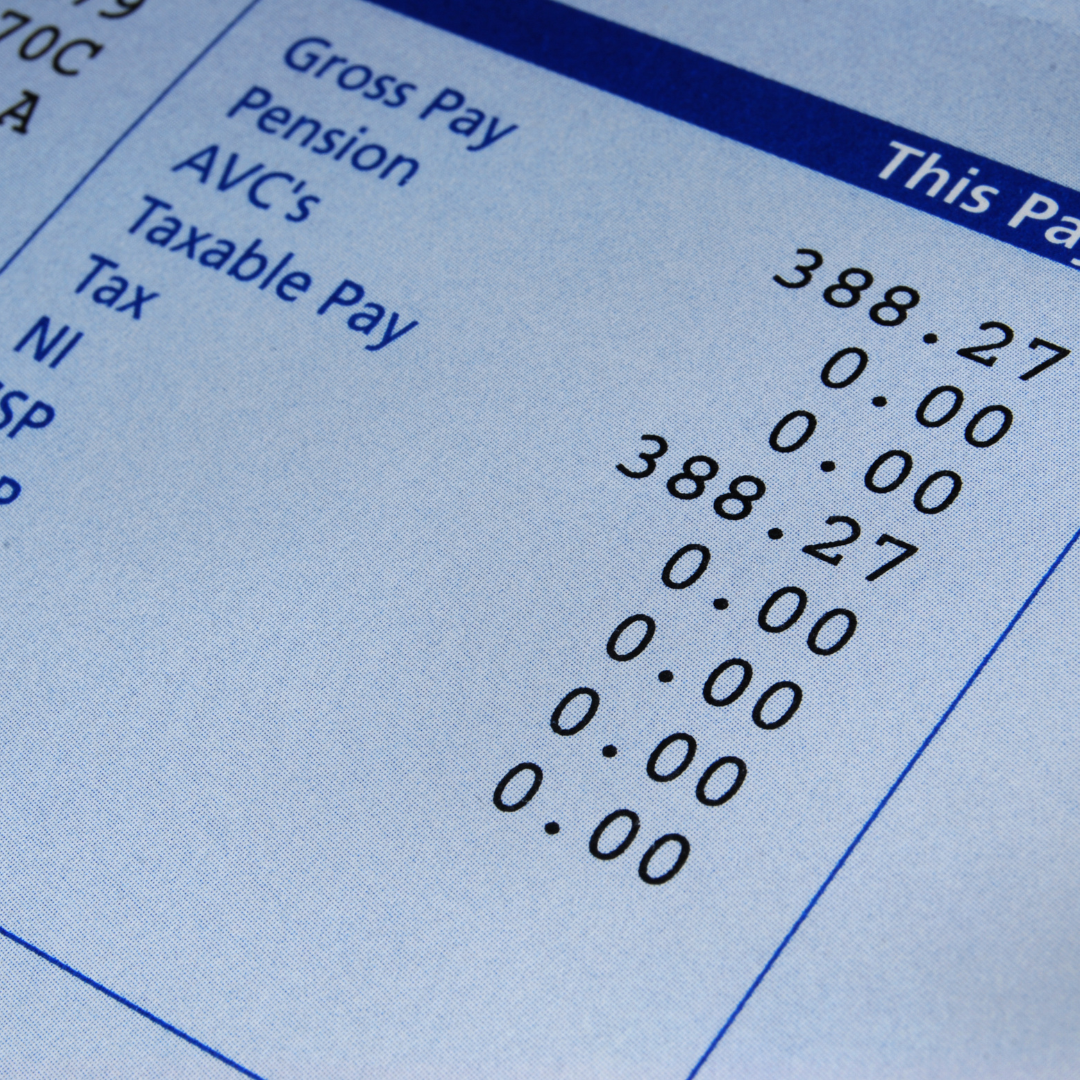

National Insurance contributions are mandatory for all workers aged sixteen to retirement age, provided they earn above a specified threshold. Currently, employees are required to contribute if they earn more than £1,048 a month (£12,570 a year), while self-employed individuals need to contribute if their annual profit exceeds £6,725.

New Changes

Starting January 6, 2024, a notable change in National Insurance contributions will take effect. Approximately twenty-seven million employees earning between £12,570 and £50,270 a year will see their contributions reduced from 12% to 10%. This reduction aims to provide financial relief to the workforce, particularly those in the mentioned income bracket.

While this decrease in National Insurance contributions is positive news for many, it is essential to consider the broader tax landscape. The government plans to offset this reduction by freezing personal tax thresholds. The basic rate of tax, a combination of National Insurance and income tax, will be reduced from 32% to 30%.

For the average worker earning a £35,400 salary, this change translates to a saving of £450 over the 2024/25 tax year. It is important to note that these adjustments are being implemented on January 6, 2024, instead of the typical start of the tax year in April. According to the Chancellor, this means that employees should start experiencing the benefits of the National Insurance contribution cut in their first pay of the year.

A handy tool to work out your new income after tax is Martin Lewis’ Income Calculator. You can input your salary and specifics to get an insight to what this change in National Insurance will mean to your salary. There is plenty of useful information on Martin Lewis’ website regarding income, but if you would like a little more personal support, we are happy to help. Give us an email or a call and we can support you with your payroll.