So, the Chancellor’s mini budget was announced on 23rd September 2022, but what does it mean for you and your payroll?

Income Tax Cut

The Chancellor has announced that the income tax of 20% will reduce to 19% from April 2023.

This will mean that for an employee earning £20,000 per year they will be £75.00 per year better off. An employee earning £30,000 per year will be £175.00 per year better off.

The Chancellor also announced plans to abolish the 45% additional rate of income tax in April 2023, which is paid by employees earning more than £150,000 a year. For an employee earning £200,000 per year the tax saving will be nearly £3,000 per year.

Income tax thresholds are different in Scotland.

National Insurance Contributions

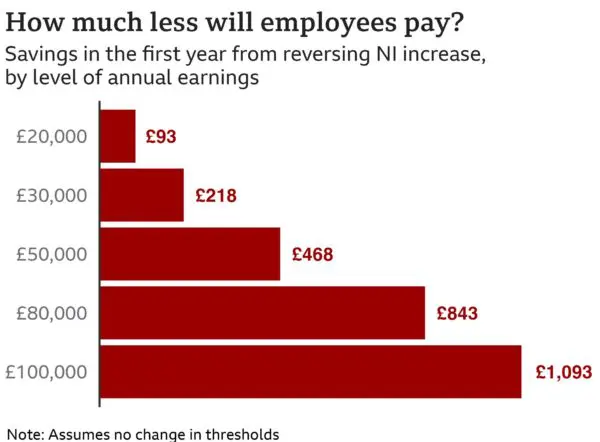

The 1.25% National Insurance Levy that was introduced earlier this year has now been reversed and will take effect from 6th November 2022.

This could potentially save employees £330.00 per year, but this is dependent on what they earn.

An employee will not benefit if they are earning less than the current threshold of £12,570.

Potential Benefit Cuts

For anyone that is on major benefits, such as Universal Credit should see a rise in what they received due to the increase of inflation.

The Chancellor will be concentrated on plans to cut benefits for those that do not complete adequate job searches and better paid jobs, or they could potentially have their benefits reduced.

For those over the age of 50 extra support will be given to help them into work.