As your payroll bureau, we want to make sure you’re fully prepared for significant changes to the UK’s Statutory Sick Pay (SSP) rules that will come into force from 6 April 2026.

- SSP Payable from Day One

Under the current system, employees must serve three unpaid “waiting days” before SSP becomes payable (usually only from the 4th day of sickness).

From 6 April 2026 this waiting period will be removed entirely.

SSP must now be paid from the employee’s first full day of sickness absence.

- All Employees Can Qualify (No Minimum Earnings Threshold)

Currently, only employees who earn above the Lower Earnings Limit (LEL) qualify for SSP.

From 6 April 2026, the LEL as an eligibility requirement will be abolished, meaning:

✔ All employees are eligible for SSP regardless of how much they earn.

✔ Part-time, zero-hours and low-paid workers who were previously excluded will now have access to SSP.

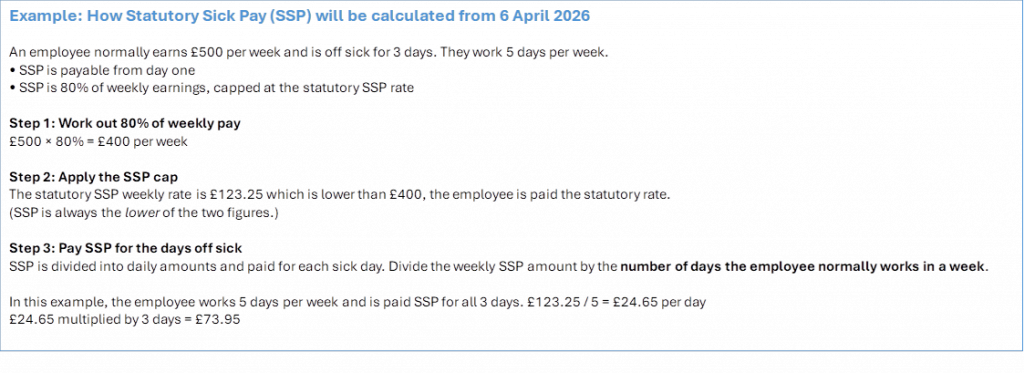

- New SSP Calculation: 80% of Earnings

The way SSP is calculated is also changing. Under the new rules, SSP will be:

- 80% of the employee’s average weekly earnings, or

- The statutory flat rate of £123.25 (whichever is the lower).

This replaces the current system, where the flat SSP rate is paid regardless of earnings. It’s designed to ensure a fairer level of support, particularly for lower-paid employees.

What This Means for Your Payroll & HR Processes

These changes are likely to impact your payroll calculations, sickness policies, and HR procedures. In particular:

Payroll systems must accommodate:

• Day-one entitlement instead of waiting days,

• New earnings-based SSP calculation,

• Wider eligibility for more employees.

Contracts and policies should be updated to reflect the new statutory entitlements.

Update us as your payroll provider with working patterns

Employee communication is key — make sure your staff understand their updated SSP rights and how it affects them.

If you have questions, please get in touch.